How to Calculate Total Assets With Liabilities & Stockholders’ Equity

23 6 月, 2021 10:22 下午 Leave your thoughtsContent

Shareholder value is what is delivered to equity owners of a corporation, because of management’s ability to increase earnings, dividends, and share prices. Equity typically refers to shareholders’ equity, which represents the residual value to shareholders after debts and liabilities have been settled. At some point, accumulated retained earnings may exceed the amount of contributed equity capital and can eventually grow to be the main source of stockholders’ equity. These may include loans, accounts payable, mortgages, deferred revenues, bond issues, warranties, and accrued expenses. The double-entry practice ensures that the accounting equation always remains balanced, meaning that the left side value of the equation will always match the right side value. The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet.

When shareholders’ equity is positive, this indicates that the company has sufficient assets to cover all of its liabilities. However, when SE is negative, this indicates that debts outweigh assets. If the shareholders’ equity remains negative over time, the company could be facing insolvency. Share capital includes all contributions from the company’s stockholders to purchase shares in the company.

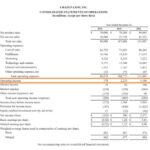

Balance Sheet Formula

A high result indicates that a company is financing a large percentage of its assets with debt, not a good thing. Basically, stockholders’ equity is an indication of how much money shareholders would receive if a company were to be dissolved, all its assets sold, and all debts paid off. This is an account on a company’s balance sheet that consists of the cumulative amount of retained earnings, contributed capital, and occasionally other comprehensive income. Stockholders’ equity is also referred to as stockholders’ capital or net assets. Describe what the value of assets would be if liabilities are $12,000 and owners’ equity is $50,000 by showing the accounting equation.

How do you calculate total assets and liabilities?

Determine total assets by combining your liabilities with your equity. Since liabilities represent a negative value, the simplest method for finding total assets with this formula is to subtract the value of liabilities from the value of equity or assets. The resulting figure equals your total assets.

Balance sheets, like all financial statements, will have minor differences between organizations and industries. However, there are several “buckets” and line items that are almost always included in common balance sheets. We briefly go through How To Calculate Total Assets, Liabilities, And Stockholders Equity commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity. The amount of your total liabilities equals the sum of the items listed in the liabilities section of your balance sheet.

What is Shareholders’ Equity?

Overall, this article provides readers with a detailed definition of stockholders’ equity along with the most common misconceptions about the value. Paid-in capital also referred to as stockholders’ funds, is the amount of money that people have invested in a company. Being an inherently negative term, Michael is not thrilled with this description. The three features of a balance sheet and how to determine each one. Banks Balance Sheet – ExplainThe bank’s balance sheet is different from the company’s balance sheet. It is prepared on the mandate by the Bank’s Regulatory Authorities to reflect the tradeoff between the bank’s profit and its risk and its financial health.

- In recent years, more companies have been increasingly inclined to participate in share buyback programs rather than issuing dividends.

- If ROE increases over time, the company is getting more efficient in generating profit from its net assets.

- A Statement of Stockholders’ Equity is a required financial document issued by a company as part of its balance sheet that reports changes in the value of stockholders’ equity in a company during a year.

- If the net realizable value of a company’s inventory falls below its carrying amount, the company must write down the value of the inventory and record an expense.

- Under IFRS, property used to earn rental income or capital appreciation is considered to be an investment property.

- The portions of liabilities and equity that comprise your total liabilities and stockholders’ equity reveal important information about your financial risk.

Liabilities represent a company’s debts, while equity represents stockholders’ ownership in the company. Total liabilities and stockholders’ equity must equal the total assets on your balance sheet in order for the balance sheet to balance. You can calculate this total and review your liabilities and equity to see how you finance your small business. Shareholders’ equity is also known as stockholders’ equity, both with the same meaning.

What are examples of assets, liabilities, equity?

The shareholders’ equity is the remaining amount of assets available to shareholders after the debts and other liabilities have been paid. The stockholders’ equity subtotal is located in the bottom half of the balance sheet. A negative shareholders’ equity means that shareholders will have nothing left when assets are liquidated and used to pay all debts owed. On the other hand, positive https://quick-bookkeeping.net/what-is-an-audit-everything-about-the-3-types-of/ shareholder equity shows that the company’s assets have been grown to exceed the total liabilities, meaning that the company has enough assets to meet any liabilities that may arise. This figure is calculated by subtracting total liabilities from total assets; alternatively, it can be calculated by taking the sum of share capital and retained earnings, less treasury stock.

DebitDebit represents either an increase in a company’s expenses or a decline in its revenue. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. All of the above ratios and metrics are covered in detail in CFI’s Financial Analysis Course. Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites.

Retained Earnings

The way in which equity holders benefit is that the earnings per share increases from a lower share count, which can often lead to an “artificial” increase in the current share price upon a share repurchase. In contrast, early-stage companies with a significant number of promising growth opportunities are far more likely to keep the cash (i.e. for reinvestments). Other Comprehensive Income The other comprehensive income line item consists of miscellaneous items such as foreign currency translation adjustments , unrealized gains on short-term securities, etc. If the retained earnings balance turns negative, then the line item is titled “Accumulated Deficit”. Treasury StockTreasury stock refers to previously issued shares that were later repurchased by the company, i.e. stock buybacks.

- These items include actual dollar amounts you owe, such as accounts payable, notes payable and deferred taxes.

- By definition, a company’s assets minus its liabilities equals its stockholders’ equity (also known as “net equity”).

- To check that you have the correct total, make sure your result matches your total assets on the balance sheet.

- In most cases, especially when dealing with companies that have been in business for many years, retained earnings is the largest component.

- However, it would make sense to obtain the previous year’s Balance Sheet to compare any trends that should be addressed in the next fiscal year.

- Current assets should be greater than current liabilities, so the company can cover its short-term obligations.

She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. Full BioAmy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. She has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals.

Shareholders Equity: Book Value vs. Market Value

Identifiable intangible assets include patents, licenses, and secret formulas. The expanded accounting equation is derived from the accounting equation and illustrates the different components of stockholder equity in a company. If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory while reducing cash capital .

If a company wants to manufacture a car part, they will need to purchase machine X that costs $1000. It borrows $400 from the bank and spends another $600 in order to purchase the machine. Its assets are now worth $1000, which is the sum of its liabilities ($400) and equity ($600). For example, a company’s brand name could be considered an asset, but it’s tough to say exactly what that brand name is worth. And, the market value of real estate and equipment is somewhat of an estimate. After all, the only way to know exactly what a building is worth is to sell it.

Non-current, or long-term assets, such as property, equipment, and intangibles (i.e., patents), are often not easily converted into cash within one year. If the same assumptions are applied for the next year, the end-of-period shareholders’ equity balance in 2022 comes out to $700,000. From the beginning balance, we’ll add the net income of $40,000 for the current period and then subtract the $2,500 in dividends distributed to common shareholders.

- The balance sheet measurement issues are, of course, closely linked to the revenue and expense recognition issues affecting the income statement.

- Often, this summary is accompanied by income statements and cash flow statements to provide a full picture of the company’s financial situation.

- This figure is calculated by subtracting total liabilities from total assets; alternatively, it can be calculated by taking the sum of share capital and retained earnings, less treasury stock.

- It shows the capacity of a profit-oriented enterprise that helps in contributing directly or indirectly to future net cash flows and in providing services.

- The double-entry practice ensures that the accounting equation always remains balanced, meaning that the left side value of the equation will always match the right side value.

- The amount of equity is increased by income earned during the year, or by the issuance of new equity.

- Bookkeeping services can help you take care of daily fiscal tasks related to your business.

If that happens, it increases stockholders’ equity by the par value of the issued stock. For example, if a company issues 100,000 common shares for $40 each, the paid-in capital would be equal to $4,000,000 and added to stockholders’ equity. A debt issue doesn’t affect the paid-in capital or shareholders’ equity accounts. Retained earnings represent the cumulative amount of a company’s net income that has been held by the company as equity capital and recorded as stockholders’ equity.

Categorised in: Bookkeeping

This post was written by pencil